“WE ARE WORKING FOR THE SOCIO-ECONOMIC TRANSFORMATION OF UGANDANSâ€- PRESIDENT MUSEVENI ASSURES NRM PARLIAMENTARY CAUCUS

President Yoweri Kaguta Museveni has assured the National Resistance Movement (NRM) Parliamentary Caucus that since coming to power in 1986, his government has been working for the socio-economic transformation of Ugandans.

“A country like Uganda is very rich, it has got a lot of national resources but the problem is that the population did not know how to use the national resources to live a good way; the modern way and that's why we have been advising them that they need to move on two fronts. Number one, free education for all and number two, prosperity /wealth creation for all,†he said.

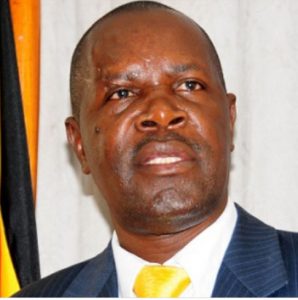

The President made the remarks today while meeting the NRM Parliamentary Caucus led by the Government Chief Whip, Hon. Denis Hamson Obua at his Kisozi farm in Gomba District. The meeting was also attended by some wealth creators in the area.

President Museveni explained that in order to achieve the desired socio-economic transformation, Ugandans need to get involved in the money economy through the four sectors of the economy which include, commercial agriculture, industries/manufacturing, services and ICT.

“Now if you go into one of those, definitely, you join the money economy because part of the problem of Uganda here was that the majority of the people were outside the money economy, they were just working for food,†he said.

“We have been educating Ugandans about commercial agriculture with “ekibaro†(to assess how much you would get). In this case we insist that separate intensive agriculture where you go for the high value enterprises from extensive agriculture where you get little money per acre but because you have done it on a big scale, you will end up getting good money.â€

President Museveni also revealed that through the government, he has been able to successfully preach the wealth creation gospel to many parts of the country like the cattle corridor.

“In the cattle corridor we have done a good job, people have joined dairy farming but where we are now, many parts are mainly crop areas and this is where we have been fighting to get this concept of intensive agriculture where people with small land can get out of poverty,†he noted.

“When I came here, of course there were a lot of contradictory messages but eventually people listened to what I was telling them.â€

On the misconception, misinformation and politicising government programmes (rationalisation, specifically the Uganda Coffee Development Authority), the President advised the legislators that, “We are going to have a showdown, they are liars and criminals playing with fire. They will not like the counterattack.â€

Ms. Sarah Nalwanga, the coordinator of the Presidential poverty alleviation program in Gomba and Sembabule Districts informed the MPs that the President started the project in 2011 where he preached wealth creation through commercial agriculture.

“People here had land but had nothing to eat since they had no knowledge on how to utilise their land. Since 2011, we have been giving out crop inputs, goats, poultry, dairy cows, coffee seedlings and banana tissues. I thank our farmers for following His Excellency’s advice on wealth creation,†she said.

Ms. Nalwanga also noted that in the 9 villages of Gomba and Sembabule, so far over 1,800 households have benefited with 769 in coffee growing, 556 in dairy farming, 336 in goat rearing, and others in other enterprises.

She also assured the President that the residents in Gomba and Sembabule are now food secure.

Mr. Mulika Noah Peterson, a coffee farmer from Kirasi thanked President Museveni for supporting them in transforming their lives through his poverty alleviation project.

“Before we started growing coffee, we were living a very miserable life but where we are now, since you supported us, we are doing well and going far,†Mr. Mulika said.

“In Kirasi we were so badly off economically, we didn't have anything but due to your efforts, we are now progressing.We thank you, Your Excellency for the transformation. I started with one acre of coffee in 2013 but now I have four acres of elite coffee and I'm adding 3 more acres. In a year I can now make Shs50 million from coffee,†he further asserted.

Ms. Rosette Kadoozi, a resident of Lutunku A also appreciated the President for transforming their lives.

“The exotic cows you gave us give us plenty of milk which we consume at home and also sell. We thank you, Your Excellency and Maama Janet for making us rich,†she said.

“In a month, I get Shs900,000 from selling milk. Thank you Mzee.â€

Mr. Lule John, the Chairperson LC1 of Kisozi A also commended President Museveni for uplifting their lives through the Presidential Poverty alleviation project.

“Yes, we may not have achieved where we want to be yet, but at least we are moving. Your Excellency, you found us when we are food insecure, yet we had the land. Your Excellency, you gave us cassava cuttings, coffee seedlings, maize and hoes. We started slowly but as I speak now, we have enough food. We have a lot of cassava, and we don't have a market for it,†he stated.

“Since you started supporting us, we are now singing a different song, Your Excellency, we are transformed.â€

Mr. Lule also informed the President that coffee has played a big role in transforming the lives of the people in his area.

“The first coffee seedling I planted was from you, Your Excellency, now I have more than 10 acres of coffee but out of those, I’m harvesting from 9 acres. Your Excellency, I'm not alone, many people have benefited from your project, and they are totally a changed story,†he said.

“I have been able to build a nice home and a new car for myself. Whenever I see you, I say if it wasn't for you, I wouldn't have bought this car.â€

Mr. Lule also castigated the people who are attacking the President over his decision on the rationalisation of the Uganda Coffee Development Authority, saying they are doing it out of ignorance.

“We have not been receiving services from these agencies like UCDA. Those saying that you don't wish well coffee farmers have a problem. When you came here in the 1990s, I was a child in school. We had only two people with coffee plantations in Kisozi A. Those were my grandfather and father who had a quarter an acre and half an acre respectively. But now we have 295 acres of coffee as people of Kisozi A.â€

He advised that the leaders such as the NRM MPs should sensitise the masses that the Coffee bill is meant to develop the coffee sector.

Earlier, the legislators and government officials had a field tour to several farms of the successful wealth creators.

The field tour was led by the Vice President H.E Jessica Alupo and also attended by members of the NRM top organ, various ministers, and a delegation led by EALA Speaker Rt. Hon Joseph Ntakirutimana.

Rt. Hon. Ntakirutimana said that they were visiting as part of an oversight effort, aiming to learn from the President's good farm practices and the experiences of local farmers.

Among those who shared their stories was Mr. Sonko Anthony, a coffee farmer, of Kifamba who reported that his 15-acre farm produced 14,400kg of coffee last season, yielding Shs 86 million.

“I am able to pay school fees for my five children,†he shared, adding that he also received banana suckers from the President, which allowed him to intercrop matooke with coffee.

2024-11-02